Investors seeking higher returns, often (ex)entrepreneurs who possess special skills or relationships, sometimes look to non-traditional investments such as start-up companies. We like to call what these highly aspirational individuals do “Angel Investing”.

Wikipedia definition of an “Angel Investor”: An angel investor or angel is an affluent individual who provides capital for a business start-up, usually in exchange forconvertible debt or ownership equity.

How To Invest Like An Angel

Since the dot com era angel investors have organized and become more sophisticated. Many angel investors now belong to investor groups such as New York Angels. Investors can find out more about their local, or industry specific, angel group through the Angel Capital Association.

Some benefits of belonging to an angel group according to the Angel Capital Association:

- Dividing the work eases the time and pain of evaluating and monitoring investments

- Standardized processes & term sheets

- Better deal flow – quality and quantity

- Greater potential to diversify your angel portfolio, and reducing risk of investment losses

- Stay current on new ideas, technology, emerging markets

- Networking and fun with a peer group of successful entrepreneurs and executives

- Build your investment skills by learning from other members

Also popular is going to events such as Y Combinator’s Demo Day and Founders Showcase, where a batch of newly created startups presents to investors all at once.

Networking is essential to surviving as an Angel investor. Angel investors tend to syndicate deals so connecting with other angels will help aspiring and existing angel investors increase deal flow and make better decisions. Personal referral is still the most common route for angel investing.

“Wait! Do I Qualify As An Angel Investor?”

Only an accredited investor, defined by the Securities Act of 1933 as a person who has net worth that exceeds $1 million or a natural person with income exceeding $200,000 in each of the two most recent years can qualify to make “angel investments”

Facts, Figures and History of Angel Investors

The term “angel” comes from the practice in the early 1900′s of wealthy businessmen investing in Broadway productions.

The Small Business Administration estimates that there are at least 250,000 angels active in the country, funding about 30,000 small companies a year. The total investment from angels has been estimated at anywhere from $20 billion to $50 billion as compared to the $3 to $5 billion per year that the formal venture capital community invests.

The Center for Venture Research at the University of New Hampshire released some of the following facts about who makes angel investments :

- The “average” private investor is 47 years old with an annual income of $90,000, a net worth of $750,000, is college educated, has been self employed and invests $37,000 per venture.

- Seven out of 10 investments are made within 50 miles of the investor’s home or office.

- Investors accept an average of 3 deals for every 10 considered. The most common reasons given for rejecting a deal are insufficient growth potential, overpriced equity, lack of sufficient talent of the management, or lack of information about the entrepreneur or key personnel.

The Top Angel Investors

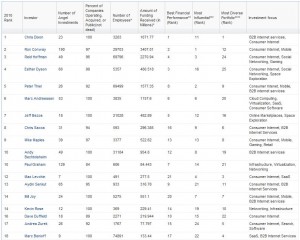

In a fantastic roundup of the top angel investors in the U.S., Business Week asked startup tracker YouNoodle to conduct some research. It turns out the top 25 angel investors have helped fund 740 new companies, create 328,698 jobs, and raise $15.2 billion. This is what the list looks like….

Some additional stories from Business Week about successful angel investors:

- Story: How We Ranked The Top Angels

- Story: Google’s Angels

- Slide Show: Google’s Real Power–Angel Investors

Everybody has the potential to be a successful Angel Investor. I hope you find yourself on that path soon.

Kevin L. Brown www.kbsinsight.blogspot.com

No comments:

Post a Comment